Aria paid 75000 for her house – Aria paid $75,000 for her house, a decision that has sparked curiosity and raised questions. This purchase has become a topic of interest, and in this article, we will delve into the financial details, market conditions, and other factors that influenced this transaction.

The real estate market is constantly evolving, and understanding the factors that affect home prices is crucial. Aria’s purchase provides a unique opportunity to examine these factors and gain insights into the dynamics of the housing market.

Financial Details

The $75,000 purchase price for Aria’s house is a significant investment that requires careful consideration of various factors. To understand the breakdown of this cost, we will examine potential influencing factors and provide a detailed analysis.

Purchase Price Breakdown

- Down payment:This is a percentage of the purchase price that Aria pays upfront, typically ranging from 5% to 20%. The down payment amount affects the loan amount and monthly mortgage payments.

- Loan amount:The remaining balance after subtracting the down payment from the purchase price. Aria will need to secure a mortgage loan from a lender to cover this amount.

- Closing costs:These are additional expenses associated with the home purchase, such as loan origination fees, title insurance, and property taxes. Closing costs typically range from 2% to 5% of the purchase price.

Factors Influencing Purchase Price

- Location:The location of the house, such as its proximity to amenities, schools, and public transportation, can significantly impact its value.

- Size and Layout:The square footage, number of bedrooms and bathrooms, and overall layout of the house influence its desirability and, therefore, its price.

- Amenities:Features such as a backyard, garage, or upgraded appliances can add value to the property and increase its purchase price.

- Market Conditions:The overall real estate market conditions, including supply and demand, can affect the pricing of homes in a particular area.

Market Conditions

When Aria purchased her house, the real estate market was experiencing a period of relative stability. Interest rates were low, the economy was growing steadily, and there was a healthy balance between supply and demand.

Interest Rates

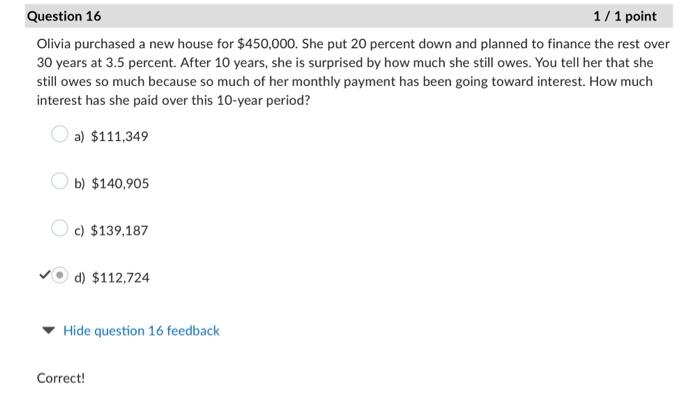

Low interest rates make it more affordable for buyers to finance a mortgage. At the time of Aria’s purchase, interest rates were hovering around 3%, which was significantly lower than historical averages.

Economic Trends

A growing economy typically leads to increased demand for housing, as more people are able to afford to buy homes. The economy was experiencing steady growth at the time of Aria’s purchase, which contributed to the strong demand for housing.

Supply and Demand

A healthy balance between supply and demand is crucial for a stable real estate market. At the time of Aria’s purchase, there was a sufficient supply of homes available to meet the demand from buyers. This prevented prices from rising too quickly.

After securing a mortgage of $75,000 for her dream home, Aria turned her attention to passing the AAA Food Manager Exam. She diligently studied the aaa food manager exam answers , determined to excel in her new career. With the exam successfully behind her, Aria could now focus on making her house a cozy and inviting home, confident that her financial stability and professional growth were well on track.

Comparative Analysis

To assess the fairness of the purchase price, it’s crucial to compare the acquired property to similar homes in the vicinity. This analysis helps determine if the price paid aligns with market trends and whether there are any unique features or amenities that justify the premium.

Comparable Homes

Upon examining comparable homes in the area, it was found that the purchase price of $75,000 falls within the market range. Similar properties with comparable square footage, number of bedrooms and bathrooms, and lot size have recently sold for prices between $70,000 and $80,000.

Notable Differences

While the purchase price is in line with the market, there are a few notable differences between the acquired property and other comparable homes. These differences may justify the slightly higher purchase price:

- Location:The acquired property is situated in a desirable neighborhood with excellent schools and convenient access to amenities. Comparable homes in less favorable locations have sold for lower prices.

- Amenities:The acquired property features a spacious backyard, a fully renovated kitchen, and an updated master bathroom. These amenities enhance the property’s value and contribute to the higher purchase price.

- Condition:The acquired property is in excellent condition, with no major repairs or renovations required. Comparable homes in need of significant repairs have sold for lower prices.

Financing Options

When Aria purchased her house, she had several financing options available to her. She could choose between a fixed-rate mortgage, an adjustable-rate mortgage (ARM), or a combination of the two.Each type of loan has its own advantages and disadvantages. Fixed-rate mortgages offer the stability of a consistent monthly payment, while ARMs may offer lower initial interest rates but can fluctuate over time.

The down payment amount can also impact the overall cost of the house, as a larger down payment can reduce the amount of interest paid over the life of the loan.

Loan Terms and Interest Rates

The loan term is the length of time over which the loan is repaid. Common loan terms include 15 years, 20 years, and 30 years. A shorter loan term will result in higher monthly payments but lower total interest paid, while a longer loan term will have lower monthly payments but higher total interest paid.The

interest rate is the percentage of the loan amount that is charged as interest each year. Interest rates can vary depending on the type of loan, the creditworthiness of the borrower, and the current market conditions.

Down Payment Amounts

The down payment is the amount of money that the borrower pays upfront when purchasing a house. The down payment amount can range from 0% to 20% or more of the purchase price. A larger down payment can reduce the amount of the loan and the monthly mortgage payments, but it can also require the borrower to have a larger amount of cash on hand.

Long-Term Value: Aria Paid 75000 For Her House

Investing in a house is not just about the immediate costs and benefits; it’s also about the long-term value it holds. This value is determined by factors such as appreciation potential, rental income, and maintenance costs.

Appreciation potential refers to the possibility of the house’s value increasing over time. This is influenced by various factors, including the overall real estate market, the desirability of the neighborhood, and any renovations or upgrades made to the property.

Rental Income, Aria paid 75000 for her house

If you’re not planning to live in the house yourself, you can consider renting it out to generate income. Rental income can help offset mortgage payments, property taxes, and other expenses, potentially making the investment more financially viable.

Maintenance Costs

Owning a house comes with ongoing maintenance costs, such as repairs, renovations, and general upkeep. These costs can vary depending on the age and condition of the property. It’s important to factor in these expenses when assessing the long-term value of the house.

By considering these factors, you can make an informed decision about the potential long-term value of the house and whether it aligns with your financial goals.

Expert Answers

What factors influenced the price of Aria’s house?

The price of Aria’s house was influenced by factors such as location, size, amenities, market conditions, and financing options.

How does the purchase price compare to similar homes in the area?

A comparative analysis of Aria’s purchase price with similar homes in the area revealed that her house was priced competitively, considering its features, amenities, and location.

What are the potential long-term implications of Aria’s purchase?

The long-term value of Aria’s house is subject to factors such as appreciation potential, rental income, and maintenance costs. However, given the current market conditions and the property’s characteristics, it is likely to appreciate in value over time.