The laws governing Medicare Parts C and D are a complex but essential aspect of the Medicare program, providing guidance for both beneficiaries and providers. Understanding these laws is crucial for ensuring compliance and maximizing the benefits available through these programs.

This article provides a comprehensive overview of the legal framework surrounding Medicare Parts C and D, including eligibility criteria, enrollment processes, benefits and coverage options, key regulations, compliance requirements, beneficiary rights and protections, recent legal developments, and potential future changes.

Introduction

Medicare Parts C and D are crucial components of the Medicare program, providing beneficiaries with comprehensive coverage for various healthcare services.

Part C, also known as Medicare Advantage, offers an alternative to traditional Medicare by allowing beneficiaries to receive their benefits through private insurance companies. Part D, the Medicare Prescription Drug Plan, provides coverage for prescription medications.

Laws Governing Medicare Parts C and D

Medicare Parts C and D are governed by a complex set of laws and regulations, including the Social Security Act, the Medicare Modernization Act of 2003, and the Affordable Care Act.

These laws establish the eligibility criteria, benefit structure, and payment methodologies for both programs.

The Centers for Medicare & Medicaid Services (CMS) is responsible for administering Medicare Parts C and D and ensuring compliance with the governing laws and regulations.

Medicare Part C (Medicare Advantage)

Medicare Part C, also known as Medicare Advantage, is a privatized health insurance program that provides comprehensive medical coverage to Medicare beneficiaries. It is offered by private insurance companies that contract with the Centers for Medicare & Medicaid Services (CMS).

Eligibility Criteria and Enrollment Process, Laws governing medicare parts c and d

To be eligible for Medicare Part C, individuals must be enrolled in Medicare Part A (hospital insurance) and Part B (medical insurance). They must also reside in the service area of the insurance company offering the plan.

Enrollment in Medicare Part C is voluntary and can be done during the annual Medicare open enrollment period (October 15th – December 7th) or during special enrollment periods (e.g., due to changes in health or residence).

Benefits and Coverage Options

Medicare Part C plans provide a wide range of benefits and coverage options, including:

- Hospitalization and skilled nursing facility care

- Physician and outpatient services

- Prescription drug coverage

- Dental, vision, and hearing coverage (in some plans)

Plans may vary in terms of premiums, deductibles, and copayments. Some plans also offer additional benefits, such as fitness programs or transportation services.

Medicare Part D (Prescription Drug Coverage)

Medicare Part D, also known as the Medicare prescription drug benefit, is a federal program that provides prescription drug coverage to Medicare beneficiaries. Part D is a voluntary program, and beneficiaries can choose to enroll in a Part D plan offered by private insurance companies.

The legal framework for Medicare Part D is established by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA). The MMA created the Medicare Part D program and established the basic requirements for Part D plans.

Eligibility Criteria and Enrollment Process, Laws governing medicare parts c and d

To be eligible for Medicare Part D, you must be enrolled in Medicare Part A or Part B. You can enroll in a Part D plan during the Initial Enrollment Period (IEP), which is the seven-month period that begins three months before you turn 65 and ends three months after you turn 65. You can also enroll in a Part D plan during the Annual Enrollment Period (AEP), which is from October 15 to December 7 each year.

To enroll in a Part D plan, you can contact the plan directly or you can use the Medicare Plan Finder tool on the Medicare website.

Benefits and Coverage Options

Part D plans offer a variety of benefits and coverage options. The benefits and coverage options available under Part D plans vary depending on the plan. However, all Part D plans must cover at least the following:

- Prescription drugs

- Vaccines

- Insulin

- Diabetes supplies

Part D plans also offer a variety of additional benefits, such as:

- Generic drug coverage

- Brand-name drug coverage

- Mail-order drug coverage

- Coverage for drugs used to treat chronic conditions

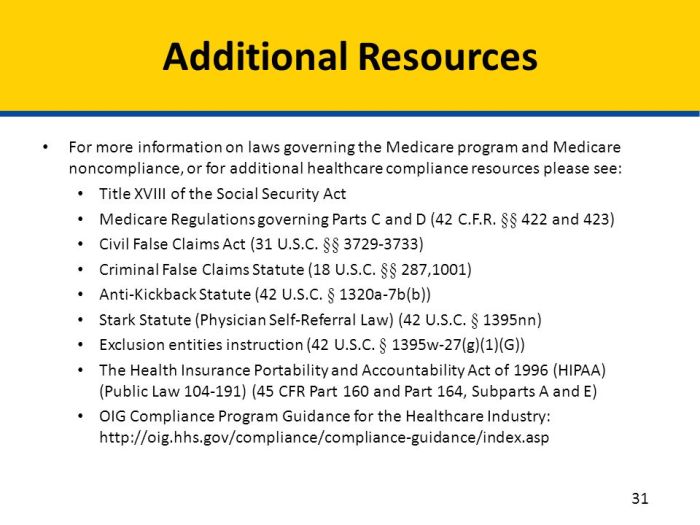

Key Regulations and Compliance

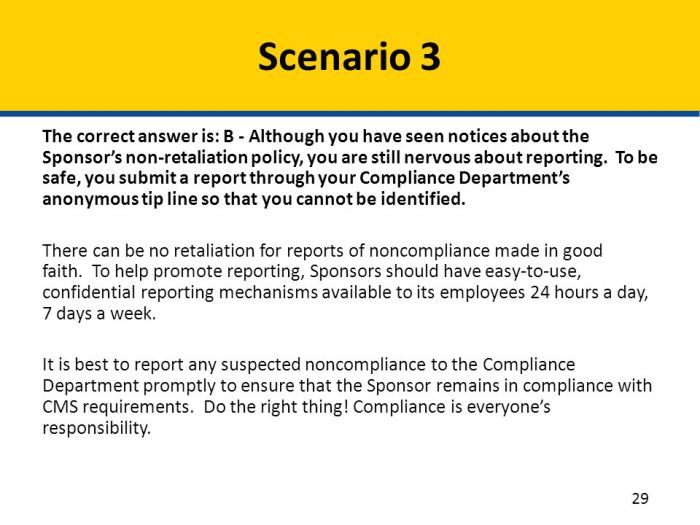

Medicare Parts C and D are governed by a complex set of regulations and compliance requirements. These regulations are designed to ensure the quality of care and protect the rights of beneficiaries. Providers and beneficiaries must be aware of these regulations to avoid penalties and ensure compliance.

Key Regulations

- The Social Security Act (SSA) establishes the legal framework for Medicare.

- The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 created Medicare Part D.

- The Affordable Care Act (ACA) made significant changes to Medicare Parts C and D.

- The Centers for Medicare & Medicaid Services (CMS) is responsible for administering Medicare.

- The Office of Inspector General (OIG) investigates fraud and abuse in Medicare.

Compliance Requirements for Providers

Providers must comply with the following requirements:

- Obtain and maintain a valid Medicare provider number.

- Follow Medicare billing and coding rules.

- Provide medically necessary services.

- Maintain accurate medical records.

- Protect the privacy of patient information.

Compliance Requirements for Beneficiaries

Beneficiaries must comply with the following requirements:

- Enroll in a Medicare Part C or D plan.

- Pay their premiums on time.

- Follow the rules of their plan.

- Report any changes in their income or health status.

Penalties for Non-Compliance

Non-compliance with Medicare regulations can result in penalties for both providers and beneficiaries. These penalties can include:

- Fines

- Suspension from Medicare

- Exclusion from Medicare

- Criminal prosecution

Beneficiary Rights and Protections

Medicare Part C and D beneficiaries have specific rights and protections to ensure their fair treatment and access to quality healthcare services. These rights include:

- The right to timely and accurate information about their coverage and benefits.

- The right to file appeals if they believe a claim or coverage decision was denied incorrectly.

- The right to confidentiality of their medical records.

- The right to choose their own providers within the Medicare network.

- The right to file complaints if they believe their rights have been violated.

Appeals Process

If a beneficiary believes their claim or coverage decision was denied incorrectly, they can file an appeal. The appeals process has several levels:

- Redetermination: The beneficiary can request a redetermination of the decision from the insurance company.

- Reconsideration: If the redetermination is denied, the beneficiary can request a reconsideration by an independent reviewer.

- Hearing: If the reconsideration is denied, the beneficiary can request a hearing before an administrative law judge.

- Judicial Review: If the hearing decision is unfavorable, the beneficiary can file a lawsuit in federal court.

Role of the Medicare Ombudsman

The Medicare Ombudsman is a state-based program that provides free and confidential assistance to Medicare beneficiaries. Ombudsmen can help beneficiaries with:

- Understanding their rights and benefits.

- Filing appeals.

- Resolving complaints.

- Providing information about long-term care options.

Recent Legal Developments: Laws Governing Medicare Parts C And D

Medicare Parts C and D have undergone significant legal developments in recent years. These changes have impacted both beneficiaries and providers, shaping the landscape of these programs.

One key development has been the passage of the Medicare Access and CHIP Reauthorization Act (MACRA) in 2015. MACRA introduced a new payment model for Medicare Part C plans, known as the Merit-based Incentive Payment System (MIPS). MIPS rewards plans for providing high-quality, cost-effective care and penalizes those that do not.

Impact on Beneficiaries

The legal developments have had a mixed impact on beneficiaries. On the one hand, MACRA has incentivized Part C plans to improve the quality of care they provide. This has led to increased access to preventive services, chronic disease management programs, and other benefits.

On the other hand, some beneficiaries have faced higher costs under the new payment model. Part C premiums have risen in recent years, and some plans have reduced the benefits they offer in order to meet the MIPS requirements.

Impact on Providers

The legal developments have also had a significant impact on providers. MACRA has increased the administrative burden on providers, as they are now required to track and report data on their performance under MIPS. This has led to increased costs for providers and has made it more difficult for some to participate in the Medicare program.

Potential Future Changes

The legal landscape surrounding Medicare Parts C and D is constantly evolving. Several proposed changes could significantly impact these programs in the future.

- One proposal is to expand the role of Medicare Advantage plans in providing long-term care services.

- Another proposal is to create a new Part D benefit for dental care.

- These changes could have a major impact on the way Medicare is delivered and could significantly affect beneficiaries and providers.

Common Queries

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, is a private health insurance plan that provides an alternative to traditional Medicare. Part C plans offer a range of benefits and coverage options, including medical, prescription drug, and dental coverage.

Who is eligible for Medicare Part C?

Individuals who are enrolled in Medicare Part A and Part B are eligible to enroll in Medicare Part C. Some individuals may also be eligible for premium subsidies to help cover the cost of their Part C plan.

What is Medicare Part D?

Medicare Part D is a prescription drug coverage program that helps beneficiaries pay for their prescription medications. Part D plans are offered by private insurance companies and provide a range of coverage options and formularies.

Who is eligible for Medicare Part D?

Individuals who are enrolled in Medicare Part A or Part B are eligible to enroll in Medicare Part D. Some individuals may also be eligible for premium subsidies to help cover the cost of their Part D plan.